Bigfoot Crane Company

We built Bigfoot by thinking long term. We invest in equipment that lasts, people who want careers not just jobs, and decisions that make sense years down the road, not just this quarter.

This Bitcoin savings option exists for the same reason.

We believe Bitcoin is an important tool for long-term savings. We use it ourselves. We believe it deserves a place alongside traditional options. Our role is simple. We provide access. What you do with it is entirely your choice.

No one is expected to participate. No one is encouraged or discouraged. This is about access, not advice.

We are not interested in hype or quick wins. We are interested in protecting the value of work over time.

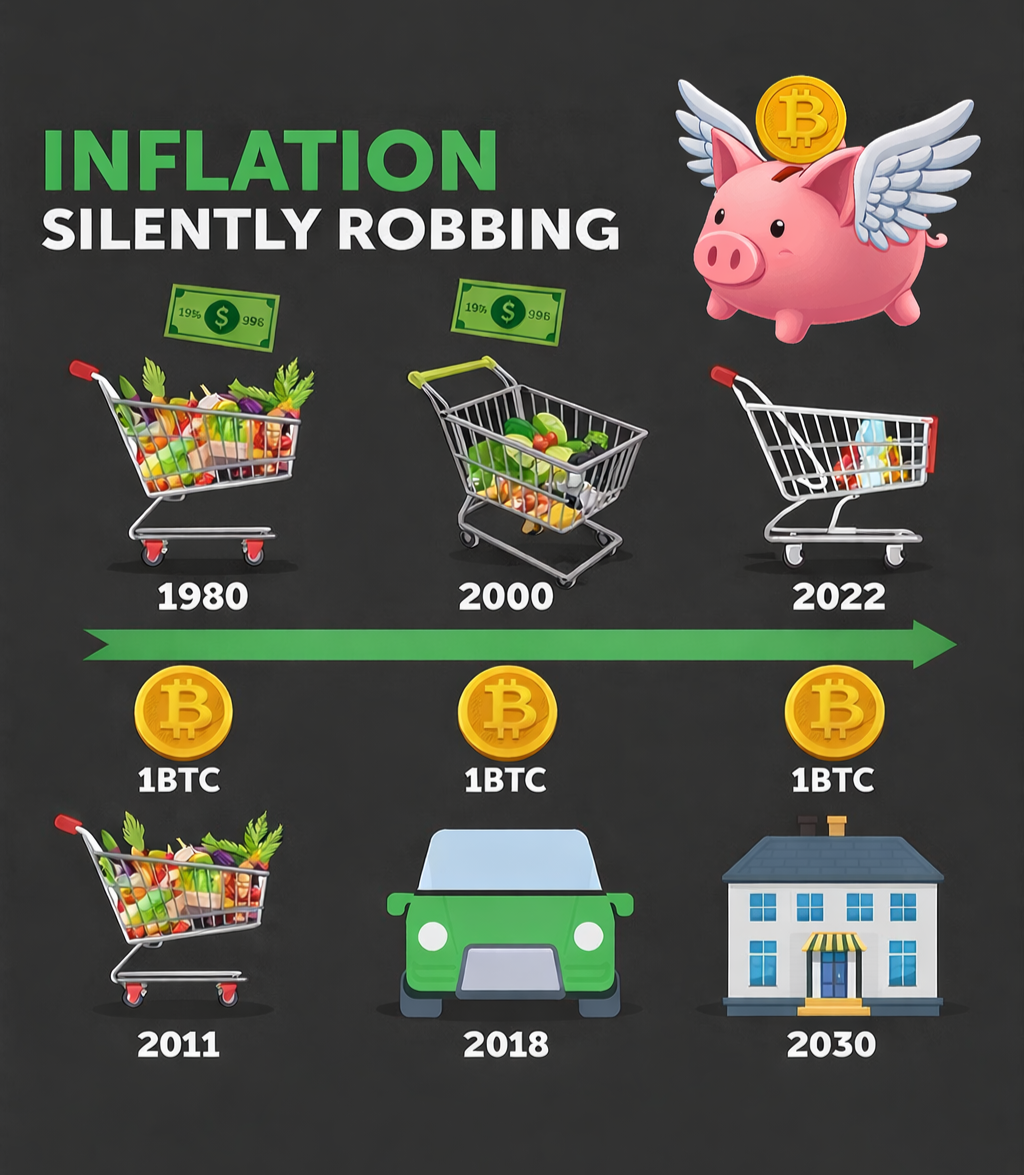

We believe inflation is real, even when it is not obvious. Most people feel it through higher costs, shrinking purchasing power, and savings that do not stretch as far as they used to.

Bitcoin was created as a response to that problem.

For us, Bitcoin is not about predicting price or chasing returns. It is about having an option that sits outside the traditional financial system. It is about independence, discipline, and thinking in decades instead of months.

We believe people should have the ability to make their own informed decisions about their future.

This plan is optional. It is not a recommendation or requirement. It exists to remove friction for those who want access.

We were intentional about how this was set up. We wanted clarity, not complexity.

If you choose to take part, you should always understand what is happening and why.

We do not expect anyone to blindly trust something they do not understand. These are resources we personally trust and continue to learn from ourselves.

‘Jargon Free’ Bitcoin & Finance Education. Click here to learn more.

www.lookingglasseducation.com

Dishonest Money: If you want to understand how the so-called “Federal Reserve System” operates (how it drives prices up, creates booms and busts, transfers wealth and power from the average working citizen to the elite who pull the strings) set aside half a day and read Dishonest Money: Financing the Road to Ruin.

The Hidden Cost of Money: Do you ever feel like you’re treading water, struggling to keep up with the rising tide of expenses? From groceries to housing to transportation, your cost of living continues to climb while your wages struggle to keep up.

It’s a frustrating and often isolating feeling. But the truth is, not only are you not alone in this struggle, but you are not the problem. The challenges we face stem from our money!

The Hidden Cost of Money by Seb Bunney, co-founder and CEO of the financial education platform Looking Glass, peels back the layers, revealing how money weaves its influence throughout our social, economic, and political spheres. Whether we’re talking about how we, as individuals, interact with the world, environmental degradation, the deterioration of the family unit, or the rise of unproductive business practices, one underlying force connects them all:money.

The Price Of Tomorrow: We live in an extraordinary time. Technological advances are happening at a rate faster than our ability to understand them, and in a world that moves faster than we can imagine, we cannot afford to stand still. These advances bring efficiency and abundance—and they are profoundly deflationary. Our economic systems were built for a pre-technology era when labour and capital were inextricably linked, an era that counted on growth and inflation, an era where we made money from inefficiency. That era is over, but we keep on pretending that those economic systems still work. The only thing driving growth in the world today is easy credit, which is being created at a pace that is hard to comprehend—and with it, debt that we will never be able to pay back. As we try to artificially drive an economic system built for the past, we are creating more than just economic trouble. On our current path, our world will become profoundly more polarized and unsafe. We need to build a new framework for our local and global economies, and soon; we need to accept deflation and embrace the abundance it can bring. Otherwise, the same technology that has the power to bring abundance to us and our world will instead destroy it. In this extraordinary contrarian book, Jeff Booth, a leading mind and CEO in e-commerce and technology for 20 years, details the technological and economic realities shaping our present and our future, and the choices we face as we go forward—a potentially alarming, but deeply hopeful situation.

The Fiat Standard: In The Fiat Standard, world-renowned economist Saifedean Ammous applies his unique analytical lens to the fiat monetary system, explaining it as a feat of engineering and technology just as he did for bitcoin in his global bestseller The Bitcoin Standard.

This time, Ammous delves into the world’s earlier shift from the gold standard to today’s system of government-backed fiat money—outlining the fiat standard’s purposes and failures; deriving the wider economic, political, and social implications of its use; and examining how bitcoin will affect it over time.

With penetrating insight, Ammous analyzes global political currencies by analogy to bitcoin: how they’re “mined” whenever government-guaranteed entities create loans, their lack of inherent restraints on inflation, and the rampant government intervention that has resulted in heavy, devastating, and persistent distortions to global markets for food, fuel, science, and education.

The Bitcoin Standard: When a pseudonymous programmer introduced “a new electronic cash system that’s fully peer-to-peer, with no trusted third party” to a small online mailing list in 2008, very few people paid attention. Ten years later, and against all odds, this upstart autonomous decentralized software offers an unstoppable and globally accessible hard money alternative to modern central banks. The Bitcoin Standard analyzes the historical context to the rise of Bitcoin, the economic properties that have allowed it to grow quickly, and its likely economic, political, and social implications.

While Bitcoin is an invention of the digital age, the problem it purports to solve is as old as human society itself: transferring value across time and space. Author Saifedean Ammous takes the reader on an engaging journey through the history of technologies performing the functions of money, from primitive systems of trading limestones and seashells, to metals, coins, the gold standard, and modern government debt. Exploring what gave these technologies their monetary role, and how most lost it, provides the reader with a good idea of what makes for sound money, and sets the stage for an economic discussion of its consequences for individual and societal future-orientation, capital accumulation, trade, peace, culture, and art. Compellingly, Ammous shows that it is no coincidence that the loftiest achievements of humanity have come in societies enjoying the benefits of sound monetary regimes, nor is it coincidental that monetary collapse has usually accompanied civilizational collapse.

The Sovereign Individual: Two renowned investment advisors and authors of the bestseller The Great Reckoning bring to light both currents of disaster and the potential for prosperity and renewal in the face of radical changes in human history as we move into the next century.

The Sovereign Individual details strategies necessary for adapting financially to the next phase of Western civilization.

Few observers of the late twentieth century have their fingers so presciently on the pulse of the global political and economic realignment ushering in the new millennium as do James Dale Davidson and Lord William Rees-Mogg. Their bold prediction of disaster on Wall Street in Blood in the Streets was borne out by Black Tuesday. In their ensuing bestseller, The Great Reckoning, published just weeks before the coup attempt against Gorbachev, they analyzed the pending collapse of the Soviet Union and foretold the civil war in Yugoslavia and other events that have proved to be among the most searing developments of the past few years.

Watch the video of Seb Bunney by clicking here.

There is no expectation to become an expert. Curiosity and personal research matter more than certainty.

Find answers to common questions about the Bitcoin and the Bigfoot Bitcoin Savings Plan.

No. Participation is entirely optional.

Yes. You decide what makes sense for you.

Yes. You remain in control at all times.

Bitcoin has operated continuously for over a decade. Like any financial tool, it carries risk. Understanding that risk is part of making an informed decision.

Tax treatment depends on individual circumstances. We recommend speaking with a qualified professional if you have questions.

We believe people deserve access to tools that allow them to think long term. We believe inflation quietly punishes savings. We believe independence matters.

This plan reflects how we think as owners and operators of this company. Practical. Transparent. Built for the long haul.

Our role is not to convince anyone. Our role is simply to provide access.

Legendary Careers Start Here

View our current openings: